Growing Demand for ‘Critical Minerals’?

- April 1, 2025

- Posted by: Anish

- Category: Feed

March 2025: Anish Narang, Karavan Free Trade sharing a panel with Mr. Gyanindra Kumar Pradhan, Professor of Mining Engineering & Dean Faculty, AKS University on Supply Chain for Critical Minerals organized by Spire Events in New Delhi.

For over a century, oil companies have developed an extensive industrial network to extract, refine, and distribute their products globally. However, sourcing the materials required to establish an alternative, less carbon-intensive economy presents a new array of challenges.

China has been addressing these challenges successfully for more than a decade, positioning itself as the leading authority in “critical minerals” used in equipment such as electric vehicle batteries, solar panels, and wind-turbine magnets.

To compete in these clean technologies, other nations must accelerate their efforts considerably. With Geo-Politics running high, talk of the US annexing Canada, buying Greenland and strong-arming Ukraine all seems animated by one priority: gaining greater access to critical minerals.

What are critical minerals?

Nations have long sought to secure supplies of materials they deem vital to their industrial and military capabilities. About 50 metallic elements and minerals have met those criteria including lithium, graphite, cobalt, manganese and rare earths — elements with unique chemical behaviours that make them indispensable to the manufacture of some electrical, electronic, magnetic and optical products. Most critical minerals were chosen for their role in building the infrastructure required to reduce carbon emissions blamed for climate change, a mission that’s backed by hundreds of billions of dollars in subsidies and tax breaks. Some are also used in semiconductors for civil and military communications.

Why is sourcing them a challenge?

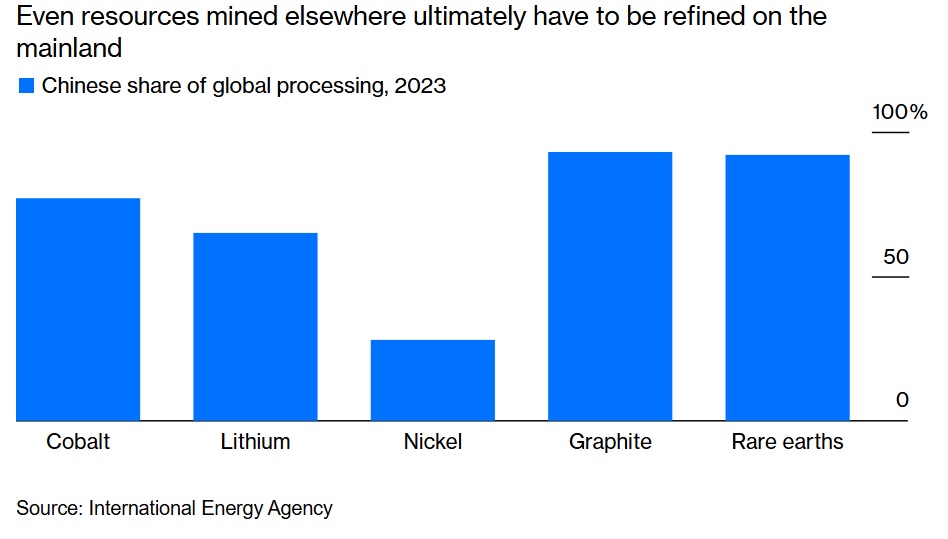

The global availability of many critical minerals is substantial; however, the processes required for their extraction and refinement are technically complex, energy-intensive, and environmentally taxing. There has been an increase in demand for these minerals due to the energy transition. China plays a major role in the value chain of several of these products. Despite the abundance of metals such as copper, high demand growth could lead to potential shortages. In 2023, the European Union classified copper and nickel as critical raw materials for the first time, reflecting their importance despite widespread availability.

Advantage China?

Manufacturers seek to avoid reliance on supplies from any single country to mitigate risks associated with disruptions in industrial output due to factors such as power shortages, epidemics, or social unrest.

In December, China banned the export of antimony, gallium, and germanium to the United States, citing national security concerns. This followed Washington’s restrictions on China’s access to certain sensitive technologies. The ban is expected to increase costs for some US manufacturers of electronic and optical equipment. Additionally, Beijing imposed stricter conditions on sales of graphite, an essential component in electric vehicle batteries. In early February, in response to new tariffs imposed by the Trump administration, China introduced export controls on tungsten, bismuth, and other niche metals used in electronics, aviation, and defense, resulting in increased prices for some of these products.

China plans to add to its strategic reserves of key industrial metals this year, an effort to boost the resilience of critical minerals supply at time when energy-transition demand is increasing, and geopolitical tensions are running high. Cobalt, copper, nickel and lithium are among the metals the Chinese government plans to purchase, according to people familiar with the discussion.

US’ Inflation Reduction Act (IRA) and invoking Emergency Powers:

While Biden’s successor Trump has disparaged his climate policies and ordered federal agencies to stop disbursing IRA funds, a complete repeal of the legislation appears unlikely. Republican lawmakers whose districts and states are benefiting from investments spurred by the IRA have pressed the president to maintain its provisions.

In March 2025, Trump took the Biden administration’s effort to reduce US reliance on minerals from China a step further, invoking emergency powers to boost domestic production and processing of the materials.

An executive order signed by the president Thursday taps the Defense Production Act as part of an effort to provide financing, loans and other investment support to domestically process critical minerals and rare earth elements, according to a White House official. The US International Development Finance Corporation, working with the Department of Defense, will provide financing for new mineral production projects.

The order, which also encourages faster permitting for mining and processing projects and a directive for the Interior Department to prioritize mineral production on federal land, comes as a direct response to long-held concerns among the US and allies that China overwhelmingly controls the processing of some of the most important critical minerals.

A House select committee on China previously recommended creating a reserve of critical minerals “to insulate American producers from price volatility” and protect against Beijing’s “weaponization of its dominance in critical mineral supply chains.”

European Union’s Critical Raw material act:

In the EU, a Critical Raw Materials Act aims to ease financing and permitting for new mining and refining projects at home and strike trade alliances to reduce Europe’s dependence on Chinese suppliers. The bloc is also pushing through a Clean Industrial Deal that will include a mechanism enabling companies in the region to pool their demand for critical materials.

India’s National Critical Mineral Mission (NCMM):

India has taken significant steps to secure its critical mineral supply through the National Critical Mineral Mission (NCMM), approved in January 2025. This initiative aims to reduce import dependency and strengthen domestic exploration, mining, and processing of critical minerals like lithium, cobalt, nickel, and rare earth elements.

India’s push for self-reliance in critical minerals is crucial for its green energy transition, semiconductor industry, and defense sector.

To conclude, all major countries have been trying to strike supply deals and investment partnerships with producing nations. However, China’s established position in many of those countries gives it an early advantage. For example, more than half of the cobalt mines in the Democratic Republic of Congo are owned or controlled by Chinese companies. Beijing is consolidating relationships with African nations that are set to be among the world’s biggest producers of the metal by the end of the decade.

The preoccupation with mineral resources is understandable. China dominates the mining and refining of several raw materials needed to produce key building blocks of modern militaries and economies, from semiconductors to radars and electric-vehicle batteries. Efforts to reshore supply chains have made halting progress: Opening new mines and processing facilities is expensive, time-consuming, environmentally fraught and commercially challenging when Chinese companies can raise or lower production to control prices.