Hydrogen is enjoying a purple patch, then, and not just among carmakers. It is being touted as a means of propelling buses and lorries, and even ships and aircraft. There is talk of it replacing natural gas as a source of heat, of it being used to store the surplus output of solar and wind power stations, of it being employed as a chemical feedstock and even of it replacing coke as a means of extracting metallic iron from its ore. If all this came to pass, then hydrogen would become a dominating factor in human life in the way that hydrocarbons currently are.

Currently the United States generates roughly 1,600 terawatt-hours (TWh) of electricity from natural gas each year, and gas demand in the power sector was estimated by the US Department of Energy at 11,000 trillion btu (Tbtu) in 2019.

While H2 is less dense than methane (the main component of natural gas) measured in weight per cubic foot, it produces more energy per unit of weight, with about 125 MMbtu/ton compared with approximately 50 MMbtu/kg for natural gas.

Hydrogen from Water

In its recent quarterly results call, US power giant NextEra announced that its utility subsidiary Florida Power & Light (FPL) plans to build a 20 megawatt electrolyzer to produce hydrogen from water.

The specific application planned by FPL solves multiple problems. First, it addresses the problem of what to do with “curtailed” solar and wind, which is the electricity generated from these sources that cannot be used and must be wasted.

Additionally, Microsoft—one of the world’s largest renewable energy buyers—is also starting to explore hydrogen. The tech giant recently joined the Hydrogen Council and has been testing fuel cells as backup power at its data centres.

All of that said, there are still challenges to development of a green hydrogen ecosystem. Electrolyzers are still quite expensive, particularly when compared to the steam methane reforming (SMR) method of hydrogen production using natural gas.

However, manufacture is moving from manual to automated production as the sector matures, and many industry observers are predicting that this technology will follow the cost declines seen with solar and battery storage as it scales.

Nikola Orders Enough Electrolysis Equipment From Nel to Produce 40,000 kgs of Hydrogen Per Day

Electric Vehicles

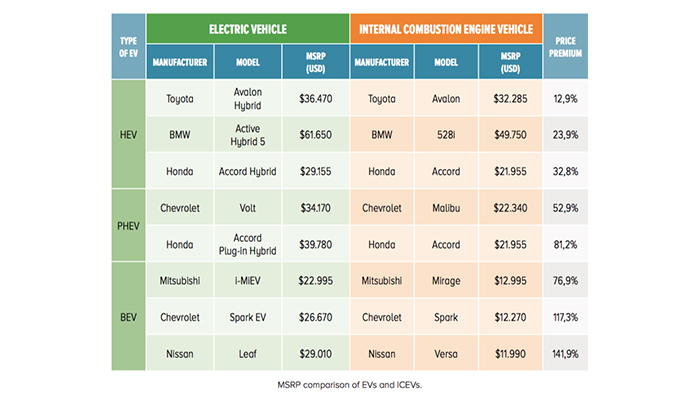

The rise of electric vehicles (EV)1 means long-established automotive players are experiencing profound and prolonged challenges such as new technologies and products, new competitors like Tesla Motors and Google, and the rise of fuel-efficiency regulations.

This potential for EV uptake, however, varies greatly across domestic markets.

Latin America EV Market Insights

- The Inter-American Development Bank is one of the main institutions that guides and funds Latin American progress. In 2010, the company stated that nearly 20,000 electric cars were sold worldwide.

- In the end of 2014, said figures exceeded 700,000 and by June 2017, gross sales surpassed the 2 million mark. Nearly half of the demand comes from the United States, a quarter from Japan, and the remaining amount belongs to China and the rest of the world.

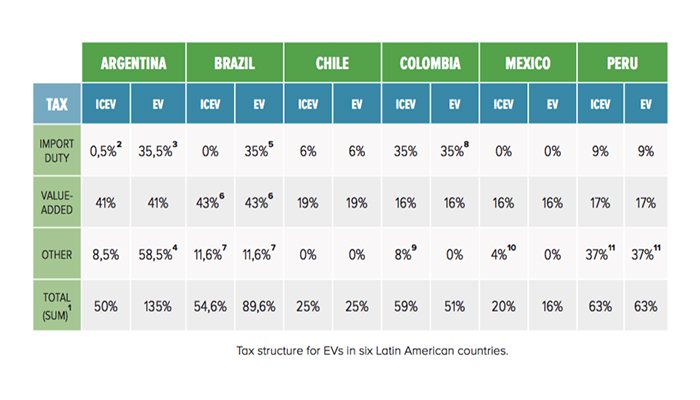

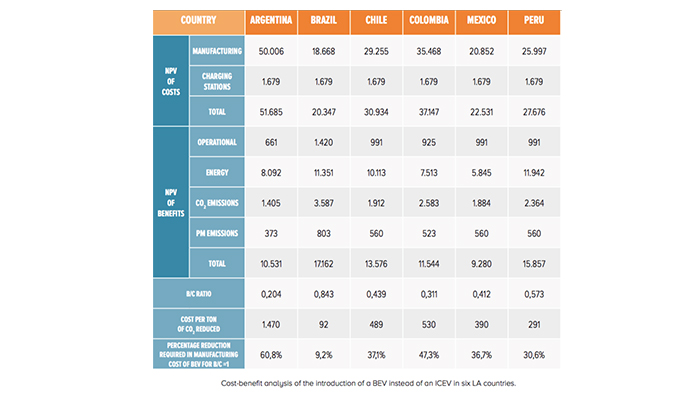

- The South American countries that lead the implementation of electric vehicles are Argentina, Brazil, Chile, Colombia, Mexico, and Peru, which are expected to be selling between 52,000 – 220,000 units per year by 2023.

- Electric cars possess an advantage over gasoline fuelled vehicles as both maintenance and fuel is cheaper. Although acquisition prices are seemingly higher for electric cars, in the long run, it remains the better deal. The benefits of charging with electricity represent a 98% discount in Argentina, 90% in Paraguay, and 70% in Brazil, Colombia, and Ecuador.

Indian EV Market Insights

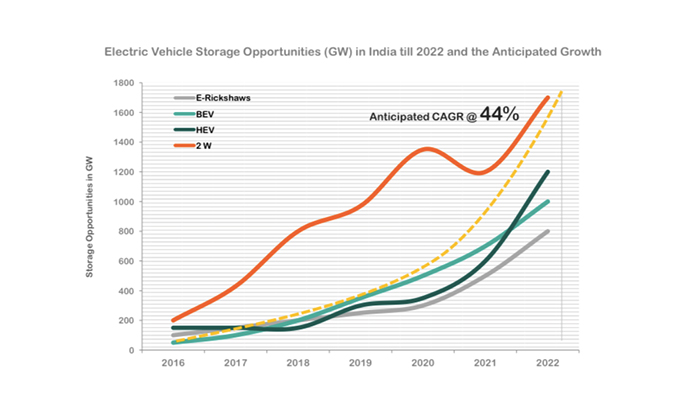

- India has this year (2017) set a target of 100 percent electric vehicles by 2030, and clearly also has in sight the self-manufacturing and opportunity to reduced oil imports that this requires. So, with the three largest nations globally (China, India and the U.S.), all embracing this transformation, the convergence of technology innovation and battery storage plus deflationary economies of scale are combining to change all aspects of global energy markets.

- The overall electric vehicle market for storage in India is likely to be 4.7 GW in 2022. Over 50% of the market in 2022 will be driven by e-rickshaw batteries. 200 charging stations are proposed to be set up in Delhi, Jaipur & Chandigarh. Delhi government launched a subsidy scheme of INR 30,000 for the E-Rickshaws in 2016. Government is targeting of 6-7 Million electric and hybrid vehicles on road by 2020. Smart charging company, new motion announced to invest INR 1000 crore in India on charging infra development.

- Some of the global automotive players like Tesla Inc. and Toyota Motor Corp. have shown interest in the Indian EV market. Nissan also plans to bring its best- selling electric vehicle Leaf to India. Suzuki Motor Corp. announced that it would form a joint venture with Denso Corp. and Toshiba Corp. to produce lithium-ion batteries for EVs in India with an initial capital expenditure of USD 184 million. Large Indian corporates like BHEL, PGCIL and Vedanta Group have shown interest in making EVs, setting up charging stations and developing storage solutions respectively.